On Wednesday, State Senators held a hearing on SB 343 – a piece of legislation governing what will happen once tuition is unfrozen for undergraduate students in Wisconsin’s public universities. Currently, Wisconsin has the longest-running and most-restrictive tuition freeze in the nation – keeping tuition frozen at the same rate since 2013.

The headlines produced from the hearing on this subject ranged from inaccurate to intentionally sensational. It became abundantly clear that there exists a significant misunderstanding around how we got to our current tuition environment and how legislation like SB 343 would affect families in our state.

My organization, Badgers United, exists as a non-partisan 501(c)3 to provide data-driven perspectives on pressing issues in higher education. We come to the public now to provide clarity on this complex issue, which will only continue to be a topic of discussion as long as tuition remains frozen in our state.

The Start Of The Tuition Freeze:

In 2013, during a fierce recession, the State Legislature was shocked to discover the UW-System had over a billion dollars in what was deemed a “slush fund” by the press and elected officials. It is important to note that a significant amount of these funds, 86%, were allocated to existing projects and the small reminder for an emergency fund – this was not an unregulated piggy bank.

However, when called before the Legislature, many of the misconceptions were unable to be clarified and, to force the UW-System to spend down the tuition reserves, the State Legislature froze in-state undergraduate tuition.

This intent is of critical importance to our understanding of this issue – the State Legislature’s top priority when it froze tuition was not to lower costs for students.

The Shifting Freeze:

Every two years, the Legislature renewed the tuition freeze and watched as UW-System began to spend down the money in their bank account. However, while this was occurring, a public explosion around the issue of student debt took place nationally. With Presidential candidates in 2016 making student debt a primary focus, that emphasis trickled down to Wisconsin.

With the all-consuming focus on educational debt, it became politically valuable to maintain the tuition freeze, and Legislators ran on campaign promises to keep tuition frozen for their constituents.

However, and of critical importance to our current situation – the tuition freeze was not designed as a mechanism to address student debt in Wisconsin, but instead was a reaction to the lack of transparency around the UW-System Tuition Fund Balance.

Digging Into The Data:

Knowing this, the question no one is asking is the single most important, “Is the tuition freeze an effective means to address student debt?”

Our organization has dug deep into the data, and we have found that the tuition freeze is not only achieving little in the way of student debt, it is jeopardizing the stability of higher education in Wisconsin.

Research finds that there are good actors and bad actors in higher education. More than 50% of student loan defaults are from for-profit or non-selective institutions that focus on generating revenue.

If we look closer at state-funded public universities like UW-Madison, we find they are national leaders in the student debt arena.

UW-Madison sees over half of graduates walk across the graduation stage with ZERO student debt, those who do have less than $30,000 in debt. Default rates for undergraduate students are around 1.2%, far lower than the national average (above 11%), and the earning potential from UW-Madison degrees remains high – well north of $500,000.

So, not only are our public university students graduating with little to no debt, they can reap the rewards of their investment throughout their lifetime. No one would be outraged if a person inherited a house worth $500,000 that still had a mortgage of $30,000, yet that is the situation we see consternation over when the public looks mistakenly groups all schools together in conversations around student debt.

SB 343

Now, seven years into a tuition freeze, we need to review what solutions are on the table to address instate undergraduate tuition and how those would affect Wisconsin families. The freeze, in its current form, is not sustainable because, although the Legislature can freeze tuition, they cannot freeze the other side of the balance sheet – costs. Inflation alone has risen by more than 10% since the freeze was put into place, raising prices without any equivalent revenue increases from tuition.

The natural extension of a tuition freeze forever is the same policy as free college more slowly rolled out. If you never increase anything over time it dwindles down to nothing with inflation.

On the table is SB 343 – a bill that does not thaw the current tuition freeze, a fact overlooked in most coverage. It is instead a roadmap for Wisconsin families – providing predictability when tuition is eventually unfrozen. This predictability comes from capping tuition increases at CPI (Consumer Price Index – an inflation measure) and providing the Board of Regents the ability to set tuition rates at any level they like, as long as it is not above a CPI increase.

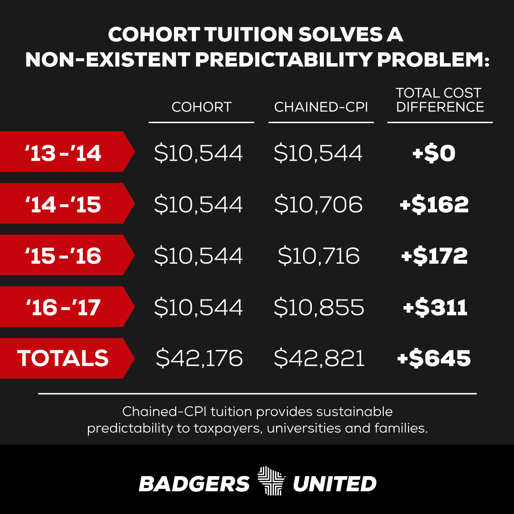

We ran the numbers to see how this bill would affect families, and we found that a UW-Madison freshman starting in 2013 would have seen $645 of increases over their four years in school – an average of $161/year. These are not the double-digit tuition increase horror stories grabbing headlines in other states. To put it plainly, in REAL dollars, adjusted for inflation, tuition will remain frozen while providing families and the university predictability – rather than relying on the State Legislature to vote every two years on an ongoing freeze.

Hopefully, this information can clarify a discussion that has become clouded in rhetoric. There is a clear imperative in the data on this subject, and we look forward to a continued conversation on this topic.

Amber Schroeder

Executive Director